Quiet title Actions

Overview

Videos

Case Studies

Quiet Title

An action to quiet title is a court procedure required to obtain an order from the court confirming that a party has a right to their real estate, free and clear from all other challenges or claims to title. Essentially the legal action “quiets” property title disputes and is otherwise known as a quiet title lawsuit.

Quiet title actions are common after a Michigan property tax sale or auction of real estate. They’re used to negate any procedural issues about the tax sale of real estate, ensuring that the county clerk performed the tax sale in accordance with Michigan statutes. When real property is sold at a tax deed sale, the effect is to eliminate any claim that the prior owner or mortgage holder or lien holder may have to the title. When a successful bidder at a tax deed sale obtains the deed to real estate, it should be free and clear of any other liens or encumbrances, except for certain excluded liens for municipalities, etc. Unfortunately, the buyer of real estate after a tax sale does not have “marketable title” unless a quiet title action is performed. A title insurance policy will not cover real estate subject to tax sale until any potential adverse claims against the property in question has been litigated.

Why is a Quiet Title Action Important?

If the matter involves a former tax sale, the buyer of a tax deed property cannot obtain title insurance bought at a tax deed sale until a complaint to quiet title action is filed and a court order is issued. Without a title insurance policy, it is difficult to sell or finance the tax deed property until a legal proceeding is initiated. In a standard Michigan real estate transaction, the buyer will insist upon title insurance in order to insure the title to the property for the amount of the purchase price. Likewise, if a successful bidder of a tax deed property wants to refinance the property, a lender institution will also require a title policy to insure title for the mortgage. A quiet title attorney will file a quiet title complaint against any potential claim and ultimately secure clean title.

Sometimes title issues have nothing to do with a county tax sale. Perhaps there is a defect in the title that requires a final order from the court. The reasons for defects are endless, but the most common are lack of discharge, challenges to boundary lines, and challenges to title ownership. These are known as clouds on title and must be removed in order to ensure that the transfer of title is free of further ownership disputes. Once a court action is successfully maintained and legal ownership is determined, then the title records will reflect the courts order. When a court makes a finding in favor of the marketability of real estate, the title company and their real estate lawyer can be assured that no additional claims or further active disputes surrounding a property’s marketability can be made.

Call David and his title attorney team to discuss whether a quiet title action is appropriate for your specific circumstances. Soble Law regularly handles properties with defective titles, clouded titles. When there is a major title problem, we obtain insurable title for our clients.

Top 10 Title Problems

Title insurance is important for new homeowners to have because, while the home may be new to you, the property will have an entire history of its own that may be unknown to you. Conducting a thorough title search can help you discover any title defects that may be tied to your newly purchased property. Depending on the title insurance you have, you need to know that a title commitment protects the homeowner against title problems that arise only after you have closed on the property. Below are the top ten common title problems that may arise in purchasing a property.

1. Errors in Public Records

Clerical or filing errors can easily occur. Everyone is human, and everyone makes mistakes. However, these kinds of errors can affect the deed or survey of your property, causing undue financial strain while you try to resolve these mistakes.

2. Unknown Liens

Unless you are purchasing a brand new home, someone owned the property before you. The prior owners of your newly purchased property may not have been thorough bookkeepers or bill payers. Even though the former debt on the property is not your own, banks or other financing companies can place liens on your property for unpaid debts even after you have closed on the same. This is a particularly worrisome and burdensome issue with certain distressed properties.

3. Illegal Deeds

Sometimes, the chain of title on your property may appear perfectly sound. However, a prior deed was made by an undocumented immigrant, a minor, a person of unsound mind, or one who is reported to be single but in actuality married. These instances can affect the enforceability of prior deeds, and thus affecting prior or present ownership.

4. Missing Heirs

When a person passes, ownership of their home may fall to their heirs or the individuals named in their will. For property to be transferred through a will, it must be probated. However, these heirs are sometimes unknown or missing at the time of the person’s passing. In other cases, family members may contest the will for their own property rights. These scenarios create both probate and real estate litigation, which can occur quite a long time after you have purchased the property. This may affect your rights to the property.

5. Forgeries

Sometimes, unfortunately, we do not live in a completely perfect and honest world. Therefore, sometimes, a forged or fabricated document that affects property ownership is filed within the public record. This obscures the rightful ownership of the property. We call it “clouding title.” Once these forgeries come to light, your rights to your home may be in jeopardy.

6. Undiscovered Encumbrances

When it comes to owning a home, three is a crowd. At the time of purchasing the property, you may not know that a third party holds a claim to all or part of your property. This could be due to a former mortgage, lien, or non-financial claims like restrictions or covenants limiting using your property. Remember, just because a person has actual possession of a home, it does not mean they are vested fully in legal title.

7. Unknown Easements

While you may own your new home and its surrounding land, it is possible that an unknown easement may prohibit you from using the property and land as you would like. It could also allow government agencies, businesses, or other parties to access all or portions of your property. While usually non-financial issues, easements can still affect your right to enjoy your property.

8. Boundary and Survey Disputes

Prior to purchasing the property, you may have reviewed and seen several surveys of the property you intended to purchase. However, it is possible that other surveys exist showing a differing boundary line from the one you observed on the surveys that you reviewed prior to purchasing the property. Therefore, a neighbor or other party may be able to claim ownership to a portion of your property.

9. Undiscovered Wills

When a property owner dies with no apparent will or heir, the state may sell the property owner’s assets. This includes the home. When you purchase such a home, you assume your rights as owner of the property. However, even some years later, the deceased owner’s will may come to light and your rights to the property may be in serious jeopardy.

10: False Impersonation of Previous Owner

Lastly, common and similar names can make it possible to falsely impersonate a property owner. If you purchase a home that was once sold by a false owner, you are at risk of losing your legal claim to the property.

Conclusion

These top ten issues, and others, are often covered by an owner’s policy of title insurance. Therefore, when you decide to purchase a home, make sure you purchase title insurance to protect your rights to the property. If you are unable to obtain title insurace, it is because the title agent questions the marektability of th title to the property. It is then that you will have to initiate your quiet title action with a real estate attorney.

Do You Have A Concern About Quieting Title?

Call Us For Your CONSULTATION

At 888.789.1715 or

Complete This Form.

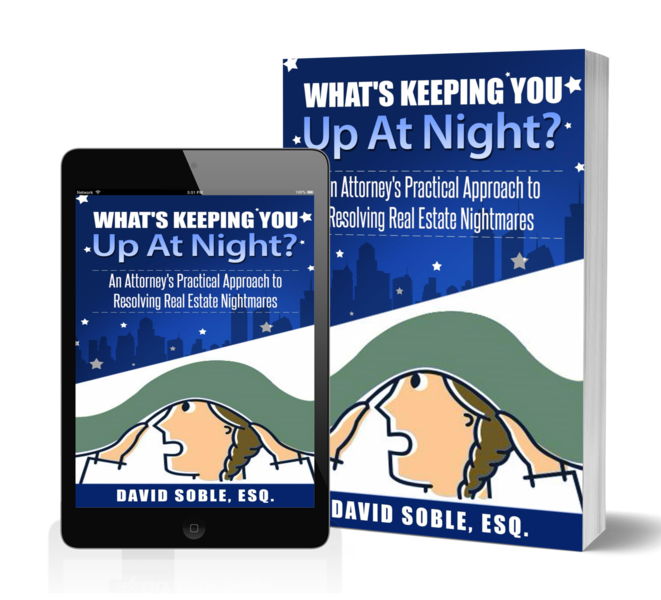

What’s Keeping You Up At Night?

An Attorney’s Practical Approach to Resolving Real Estate Nightmares

Videos

A Word About Quiet Title Actions

FAQs

Frequently Asked Questions

Top Quiet Title Actions Questions

Can the home seller sue me as a purchaser for filing a claim of interest on their property for slander of title? We now have a disagreement about the purchase agreement and I refuse to close until our problem is resolved. But I don't want the seller to be able to sell to anyone else until this issue is resolved with or without the court's involvement.

“To prove slander of title under the common law, a claimant ‘must show falsity, malice, and special damages, i.e., that the defendant maliciously published false statements that disparaged a plaintiff’s right in property, causing special damages.” Federal Nat Mortg Ass’n v Lagoons Forest Condo Ass ’n, 305 Mich App 258, 269-70; 852 NW2d 217 (2014) (quoting B&B Investment Group v Gitler, 229 Mich App 1, 8; 581 NW2d 17 (1998)). The aggrieved party must show that a claimant must “knowingly file an invalid lien with the intent to cause the plaintiff injury.” Michigan Nat Bank & Trust Co v Morren, 194 Mich App 407, 412; 487 NW2d 784 (1992).

To show malice, one must show either express malice,” which “implies a desire or intention to injure,” or implied malice,” which means “a wrongful act, done intentionally, without just cause or excuse…” Glieberman v Glieberman v Fine, 248 Mich 8, 12; 226 NW 669 (1929). Malice cannot be proven if the claim “was asserted in good faith, upon probable cause, or was prompted by a reasonable belief that [the opposing party] had rights in the real estate in question…” Id.

What does it mean to have "marketable title?"

What does it mean to have a "cloud" on title? What can I do about it?

Where can I find forms to quiet title?

I am trying to refinance a property that is owned jointly with another party. The problem is that I cannot locate them, but I suspect they would not cooperate with me anyhow. What can I do?

What if I have a border dispute and my neighbor does not agree with our property line?

How long does a Quiet title action take?

Articles About Quiet Title Actions

Read our most recent articles on this topic

Race, Notice and Delivery – The Importance of Filing Your Real Estate Deed

The Meaning of "Race Notice" Michigan is a race notice state. When there are conflicting claims of interest in a property, the party who has recorded their interest first can claim rightful ownership provided that other requirements of the state's recording statutes are met. Essentially, parties in interest must “win…

Top 10 Reasons Why You Need Property Title Insurance

The Top 10 Reasons for Title Insurance Title insurance is important for new homeowners to have because, while the home may be new to you, the property will have an entire ownership history of its own that may be unknown to you. Conducting a thorough title search can help you…

Deed Correction: What to Do When A Deed Contains Mistakes

Sometimes, not everything in life goes as planned. This is never more true than when it involves real estate and the law. At times, when drafting real estate documents, such as a deed, a mistake can happen despite the drafter’s best efforts. It is not uncommon for a deed to contain…

Why Clients Choose Us

Once You Call, You'll Appreciate the Difference.

Former Big Bank "Insider"

HigHest Peer and Client Ratings

24 Hour Response

30 +Years of Legal & Business Experience

Affordable & Approachable

Innovative & Creative solutions

We Reduce Legal Exposure & Financial Risk. Every Day.

Real Estate Law

Real estate and finance law are their own legal specialties. So how do you determine which attorney you should work with...

Contract Law

Contracts regulate expectations between parties. Working without a contract is comparable to walking a high wire without a net.

Business Law

Attorneys having years of both practical business experience as well as legal expertise are rare. David Soble is one of these...

Financial Disputes

David Soble has decades of experience as a 'big bank insider." He and his business management team are uniquely situated when it comes to handling our clients stressful financial...

Litigation

We regularly and successfully litigate real estate and contract issues. While we prefer to first resolve our client's issues reasonably and amicably, we can and certainly will escalate....

Probate & Estate Planning

For most people, their home, or other real estate, is the most valuable asset that they own. We're dedicated to protecting our clients' assets and ensure that their legal interests...

We're one of the best reviewed law firms in the community.

Don't take our word for it! See hundreds of our reviews on Google, Avvo, Social Survey and Linked In.

I am very happy I contacted David. I felt at ease as soon as I contacted him about my situation. The seller did not want to return my deposit after after a failed inspection and many other things. David got right on it and I got my full deposit back. 🙂 David was very responsive (he always replied to my emails within a few hours or even minutes). I would recommend him to anyone. Thanks again David.

Steve G, Lathrup Village, MI

![]()

I came to David Soble with an honest question; "Do I have a case?" Not only did he speak with me personally, he took time to quickly review the details of my situation. No other attorney would talk with us without a retainer. Even though he determined we did not have a case, he took the time to show us he cared! Thank you David.

Jane Blackmon

![]()

Mr. Soble is a true professional, who is very dedicated to his clients. I've been working with him for a couple of years now, and it has been a pleasure. He is very attentive to his clients' needs, and his knowledge of his field of expertise is impressive. In today's day and age it's frustrating to have to wait days for a response. That's never the case with Mr. Soble. I've always gotten a reply very quickly.

S. Volgyi (Emes Home Inspections)

Oak Park, MI

![]()

I needed an attorney and found Soble Law (proven resource) online. I took that leap of faith and called. It was a good decision! David responded quickly, was very professional, easy to talk to, and handled my mortgage issue . David told me what to expect and even did a follow up to see if I had any more questions. There is no doubt that I would use David Soble law again, and would refer others as well.

Deborah Watkins

![]()

"l was a client of Mr. Soble and he was very pleasant to work with and he took my case right away. He took time to answer all the questions and concerns that l had. When l called him, he got back to me that same day. We settled on an offer, and then received our check in a timely matter. l recommend the Soble Law firm for all your real estate needs because they take care of business."

Lisa S., Southgate, MI

![]()

The balance for one of my credit cards was over $14,000. In less than one week David and his staff were able to negotiate a new balance for less than $4000. We saved over $10,000. This was for just on one of our cards. I have to admit that my husband and I were skeptical at first, but they delivered. I now understand why the meaning behind the name. David and his staff are truly a Proven Resource!

J. James

![]()

"Attorney David Soble lives up to his firm's namesake, "Proven Resource." I appreciate knowing that when my clients need a diligent and responsive real estate or contracts attorney, I can easily make the referral to David, David is well worth having on your side."

Dino Lembesis, S. Lyon, MI

-Financial Adviser, Brighton, MI

![]()

I am very happy I contacted David. I felt at ease as soon as I contacted him about my situation. The seller did not want to return my deposit after after a failed inspection and many other things. David got right on it and I got my full deposit back. 🙂 David was very responsive (he always replied to my emails within a few hours or even minutes). I would recommend him to anyone. Thanks again David.

Steve G, Lathrup Village, MI

![]()

I came to David Soble with an honest question; "Do I have a case?" Not only did he speak with me personally, he took time to quickly review the details of my situation. No other attorney would talk with us without a retainer. Even though he determined we did not have a case, he took the time to show us he cared! Thank you David.

Jane Blackmon

![]()

Mr. Soble is a true professional, who is very dedicated to his clients. I've been working with him for a couple of years now, and it has been a pleasure. He is very attentive to his clients' needs, and his knowledge of his field of expertise is impressive. In today's day and age it's frustrating to have to wait days for a response. That's never the case with Mr. Soble. I've always gotten a reply very quickly.

S. Volgyi (Emes Home Inspections)

Oak Park, MI

![]()

I needed an attorney and found Soble Law (proven resource) online. I took that leap of faith and called. It was a good decision! David responded quickly, was very professional, easy to talk to, and handled my mortgage issue . David told me what to expect and even did a follow up to see if I had any more questions. There is no doubt that I would use David Soble law again, and would refer others as well.

Deborah Watkins

![]()

"l was a client of Mr. Soble and he was very pleasant to work with and he took my case right away. He took time to answer all the questions and concerns that l had. When l called him, he got back to me that same day. We settled on an offer, and then received our check in a timely matter. l recommend the Soble Law firm for all your real estate needs because they take care of business."

Lisa S., Southgate, MI

![]()

The balance for one of my credit cards was over $14,000. In less than one week David and his staff were able to negotiate a new balance for less than $4000. We saved over $10,000. This was for just on one of our cards. I have to admit that my husband and I were skeptical at first, but they delivered. I now understand why the meaning behind the name. David and his staff are truly a Proven Resource!

J. James

![]()

"Attorney David Soble lives up to his firm's namesake, "Proven Resource." I appreciate knowing that when my clients need a diligent and responsive real estate or contracts attorney, I can easily make the referral to David, David is well worth having on your side."

Dino Lembesis, S. Lyon, MI

-Financial Adviser, Brighton, MI

![]()

Your Legal Next Steps

Check Out Our Resource Library

We have numerous free books, articles,

and industry checklists for your use.

Join Our ‘Office Hours’ Q&A Video Call

Join David and his associates

on the 2nd and 4th Friday of each month.

Blog

Our Latest Blog Posts

IRS Tax Resolution – How We Help

Dealing with federal tax issues can be a real headache, especially for small business owners and busy individuals who have so much on their plate already. That's when Soble Law’s IRS Tax Resolution Services can really help -and our involvement can be a game-changer....

Land Contracts Michigan

Seller Finances the Land Contract A land contract is a written legal contract or agreement and it’s used to purchase real estate. It can apply to a house, apartment building, commercial building, or even vacant land, so long as it deals with real property. It’s...

An Overview of the Legal Process for Litigation

The method through which legal conflicts are settled through the judicial system is litigation. It is a formal process for settling disputes and is frequently used as a last option when all other attempts have failed. Understanding the litigation process can help you...

Podcast

Our Latest Podcasts

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.